Former Cash App Employee's Actions May Compromise Over 8 Million User Accounts

In a concerning turn of events, Cash App, a popular mobile payment application used by over 8 million users, has suffered a data breach that could potentially impact its user base. The breach occurred when a former employee downloaded reports containing personal information of Cash App's U.S. users. This incident raises concerns about data security and the protection of user privacy.

Recently Block, the financial service company that owns Cash App and was founded by Jack Dorsey, co-founder of Twitter, made a disconcerting announcement. It revealed that a former employee had accessed and downloaded user information in December. The breach was discovered after the employee had left the company, indicating that downloading the data was unauthorized and potentially malicious.

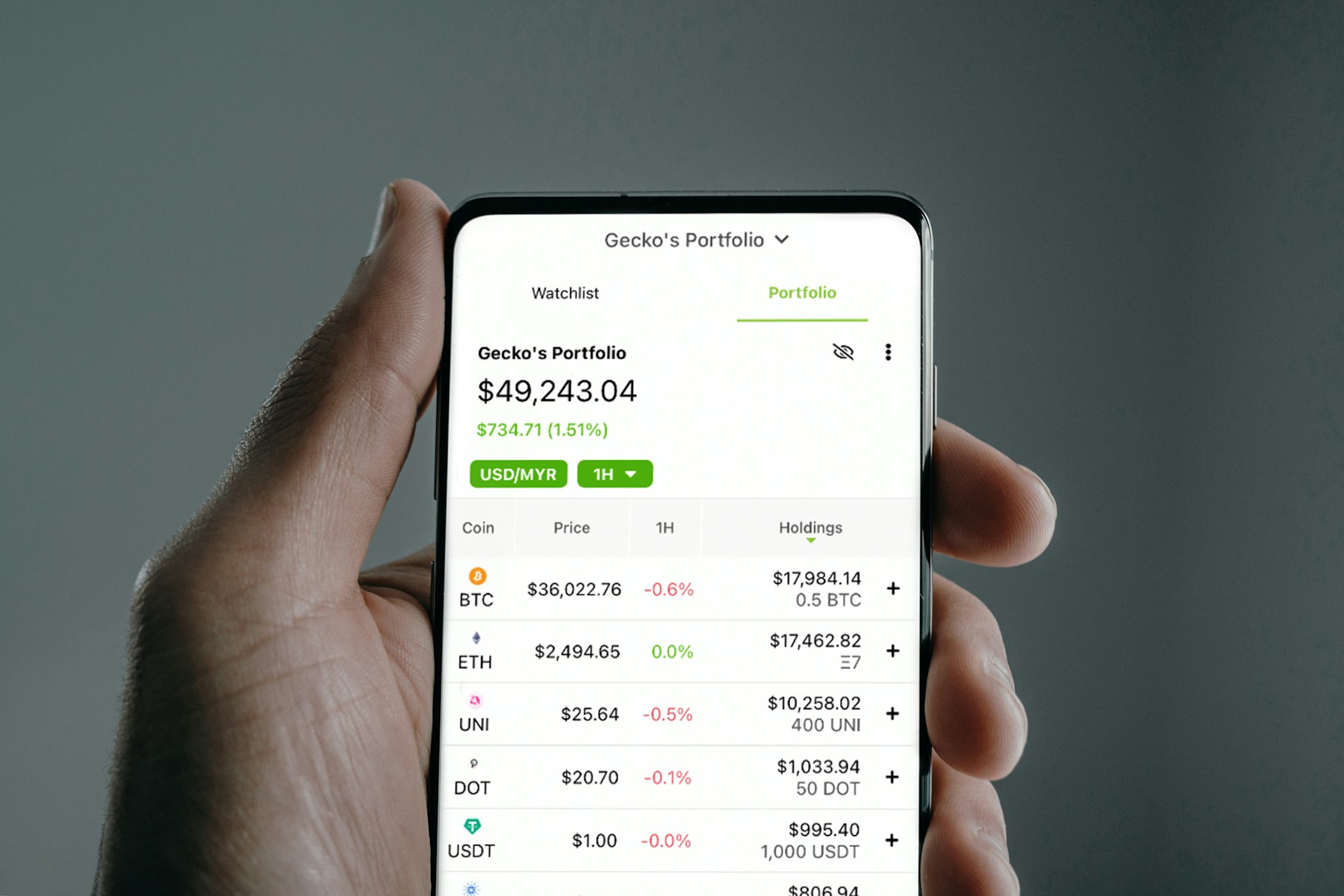

Fortunately, the downloaded data does not include sensitive information such as usernames, passwords, Social Security numbers, or bank account details. However, it does contain significant personal data, including users' full names and brokerage account numbers. These account numbers are vital in identifying a user's stock activity on Cash App Investing.

Additionally, certain breached information includes brokerage portfolio values, brokerage portfolio holdings, and/or stock trading activity for a single trading day. While immediate financial risks may not exist, this breach exposes users to potential identity theft, phishing attempts, and other fraudulent activities.

With over 8 million users affected by this data breach, the repercussions are widespread. Although the stolen information does not directly compromise users' financial accounts, it provides cybercriminals with valuable insights that can be exploited for malicious purposes.

Armed with full names, brokerage account numbers, and knowledge of the stock trading activity, malicious actors could attempt to impersonate users or launch targeted phishing attacks to deceive users into revealing more sensitive information. Furthermore, disclosing this breach may undermine user trust in Cash App, potentially tarnishing the company's reputation.

Protecting Your Privacy

As a Cash App user, you play a vital role in safeguarding your privacy.

While the breach does not expose the most sensitive information, remaining vigilant and taking necessary precautions is still crucial. Here are some steps you can take to protect your personal information:

- Regularly Monitor Your Accounts: Keep a close eye on your Cash App account for any suspicious activity or unauthorized transactions. Report any concerns to Cash App's customer support immediately.

- Enable Two-Factor Authentication: Strengthen your account security by enabling two-factor authentication. This adds an extra layer of protection by requiring a verification code and your password for login.

- Change Your Password Regularly: Periodically update your password to reduce the risk of unauthorized access. Choose strong, unique passwords that combine letters, numbers, and symbols.

- Be Wary of Phishing Attempts: Stay cautious of phishing emails, text messages, or phone calls that may attempt to trick you into revealing sensitive information. Cash App will never ask for your password or personal details via these channels.

- Stay Informed and Engage in Open Communication: Cash App is committed to transparency and will provide updates and information regarding the breach. Stay informed through official communications and engage with the Cash App community for support and guidance.

While the Cash App data breach is a cause for concern, it's crucial not to panic. You can protect your privacy and maintain control over your personal information by staying informed, taking necessary precautions, and engaging with Cash App's security measures. Remember, your privacy matters, and together we can create a safer and more secure digital landscape for all Cash App users.